Trieste, 25 November 2021 – The local Court of first instance refused to demonstrate and apply the laws in force copy-pasting an administrative judgment.

Trieste, 25 November 2021 – The local Court of first instance refused to demonstrate and apply the laws in force copy-pasting an administrative judgment.

The I. P. R. F. T. T.’s first of three lawsuits vs the Italian Government and regarding Trieste’s taxation reaches the Italian Supreme Court of Cassation.

The lawsuits, initiated by the I. P. R. F. T. T. versus the Italian Government, regard Trieste’s taxation and the management of its international Free Port.

Since 2017, 600 appellants request the legal demonstration of the present-day Free Territory of Trieste’s legal system, including taxation.

29.9.2018: the Court of Trieste decided to take no decision in lawsuit 1757/2017 regarding Trieste taxation. Immediate impugnation before che Court of Appeal.

Trieste, 15 May 2018. – The Court of Trieste accepted all the documents lodged by the I. P. R. F. T. T. in the lawsuit for Trieste’s taxation rights.

Trieste: on 11.5.2018, at hotel NH, the I. P. R. F. T. T. presents “The Free Territory and international Free Port in the Italian legal order”.

The I. P. R. F. T. T. presents new Expertise-V: the Italian legal system recognizes rights and obligations regarding the Free Territory of Trieste since 1947.

The interest of investors and enterprises for the economic regime of the International Free Port and for the fiscal and financial rights of Trieste keeps rising

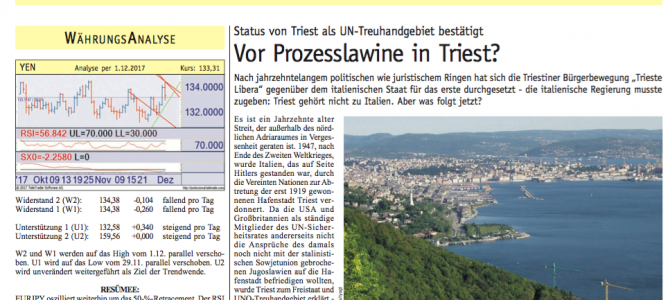

7 December 2017: Austrian newspaper Börsen-Kurier published an article by Tibor Pásztory regarding the legal action against Italian taxation in Trieste.